BOFIT Weekly Review 30/2016

Forecasts see smaller slide for Russian economy than earlier

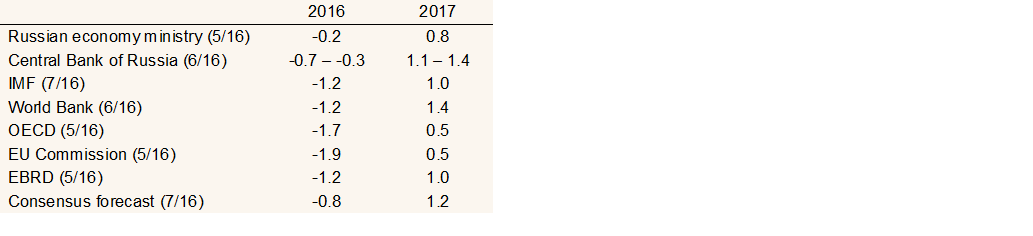

Both the IMF World Economic Outlook update released this month and the July consensus forecast of various major forecasters see Russian GDP contracting around 1 % this year. Forecasts published in late spring and early summer were somewhat cooler, although the Central Bank of Russia already at that time projected the GDP would only drop about a half a per cent, and the economy ministry drew up an even milder outlook. Several forecasts expect the volume of Russian imports to contract 4−7 % this year.

A major factor behind the improved outlooks is an almost across-the-board upward revision of the oil price assumption. Forecasts now put the average price of oil this year in the range of $40 to $45 a barrel, with the price climbing to $45−50 in 2017. Notably, Russia’s economy ministry and the central bank are offering a slightly more cautious assumption of $40 a barrel.

In addition, economy ministry estimates show Russian GDP this year fell only 0.9 % y-o-y in January-June, which was less than previous forecasts. Economic contraction was smaller on brisk growth in oil output, but it seems the GDP slide was mitigated especially by a milder fall of inventories, after inventories had declined strongly for a couple of years. This picture emerges from the first quarter GDP data and the wholesale sector that recovered through last spring.

Forecasts for Russian GDP growth in 2016 and 2017, %