BOFIT Weekly Review 28/2016

Contraction in Russian foreign trade and capital outflow slowed down

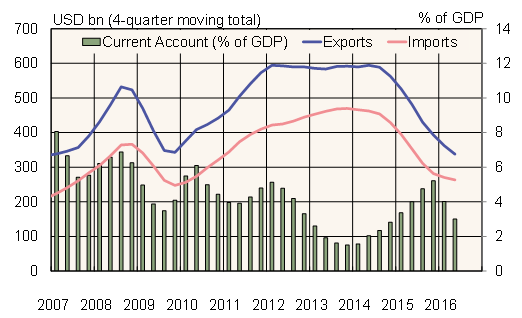

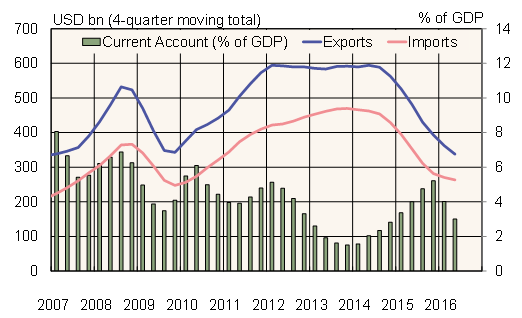

Preliminary balance-of-payments figures show the value of Russian imports shrank 10 % y-o-y in dollar terms during April-June. Goods imports were down 5 % y-o-y, while services imports plunged by over 20 %. Among the hardest hit were travel services, which were still down by more than a third in 2Q16. Largely due to low oil prices, the dollar value of Russian exports contracted on-year by a quarter in April-June. Oil & gas exports declined by about a third on-year, while other exports were off by about 15 %. With a more substantial decline in exports than imports, Russia’s current account surplus contracted in the first six months of the year to $16 billion, a level on par with 2009.

Mainly as a result of Russia’s falling foreign debt, the net outflow of private sector capital continued to slow in April-May. Banks continued to pay down their foreign currency debts and repatriate assets from abroad. For other firms, both direct investment inflows and outflows were up slightly, but the levels were quite modest – just over $6 billion. Total private sector net capital outflow in 1H16 was just over $10 billion compared to over $50 billion a year ago. The Central Bank of Russia expects the private sector net capital outflow to reach $25 billion by the end of the year.

Trends in Russian foreign trade and current account balance

Sources: Macrobond, CBR, BOFIT.

Mainly as a result of Russia’s falling foreign debt, the net outflow of private sector capital continued to slow in April-May. Banks continued to pay down their foreign currency debts and repatriate assets from abroad. For other firms, both direct investment inflows and outflows were up slightly, but the levels were quite modest – just over $6 billion. Total private sector net capital outflow in 1H16 was just over $10 billion compared to over $50 billion a year ago. The Central Bank of Russia expects the private sector net capital outflow to reach $25 billion by the end of the year.

Trends in Russian foreign trade and current account balance

Sources: Macrobond, CBR, BOFIT.