BOFIT Weekly Review 26/2016

Despite unprecedented budget-cutting, Russia posts large government deficits

Revenues to the consolidated government budget (includes federal, regional and municipal budgets plus state social funds) fell 3 % y-o-y in nominal ruble terms in the first five months of this year after having been essentially flat in 2015. Government spending has begun to adjust to the reduction in revenues. Expenditures measured in nominal rubles fell about 1 % y-o-y in January-May. The consolidated budget deficit amounted to 3 % of GDP, a deficit equal to that posted in January-May 2015. Given Russia’s established pattern of increasing government spending towards the end of the year, this presages a larger consolidated budget deficit for 2016 as a whole unless the federal government and regions take additional budget-cutting measures. For all of 2015, the deficit was 3.8 % of GDP.

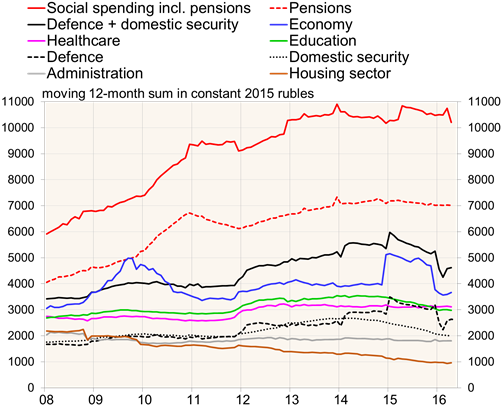

Despite a clear slowdown, inflation remains quite high and continues to erode purchasing power. For government spending, the most important figures were the 8 % y-o-y rise in consumer prices in January-May and 3.5 % y-o-y increase in industrial producer prices. The figures for all of 2015 were slightly over 15 % and slightly over 12 %, respectively. Therefore, government spending contracted substantially in real terms already last year. Over the past twelve months, spending has been around the spring 2012 level. This was the first decline in spending in real terms since 1999.

Government spending has not contracted in real terms in all main categories, however. In large social spending outlays, such as pensions, the exceptionally meagre increases of the benefits this year are only now beginning to show. The ongoing health insurance reform has sustained healthcare spending. For the moment, spending on government administration has also contracted a relatively small amount.

In contrast, the earlier upward trajectory of defence spending has turned sharply downward this year, reflecting what was decided when the federal budget was approved. Spending on domestic security and order have continued to diminish and are back to 2011 levels. Spending on education has been squeezed quite strongly, and in a few other main spending categories some of the heaviest spending cuts have been borne by research and development budgets. Russia’s government spending has not provided economic stimulus comparable to the 2009 recession (with the exception of the large lump of bank support disbursed from the federal budget in December 2014).

Real government expenditure in main spending categories

Sources: Ministry of Finance, Rosstat, BOFIT.