BOFIT Weekly Review 23/2016

Exchange rate depreciation and poor foreign trade performance reduce international yuan use

SWIFT, the Society for Worldwide Interbank Financial Telecommunication, reports that in April the yuan was used in 1.8 % of all international payments by value. The yuan was the world’s sixth-most-used payment currency, just behind the Canadian dollar. Last summer the yuan climbed to fourth place among the most-used payments currencies. Moreover, yuan’s use in Chinese foreign trade has diminished. In March-April, only 17 % of China’s foreign trade was conducted in yuan. The corresponding figure last year exceeded 25 %.

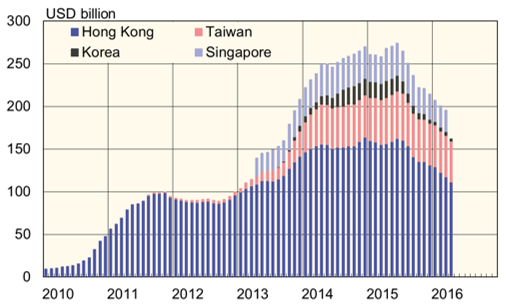

With the yuan’s falling exchange rate, yuan deposits in designated yuan trading and clearing centres outside mainland China (offshore yuan) have diminished. This trend partly reflects the PBoC’s decision last January to impose reserve requirement ratios (RRRs) on offshore yuan deposits in order to calm currency speculation. The PBoC also announced last week that as of July 15, RRRs will be based on average deposits for the quarter rather than deposits at the end of the quarter. By some estimates, the move will further reduce yuan deposits at offshore centres.

The overall readiness of firms and financial institutions to conduct business in yuan has nevertheless improved in recent years. SWIFT figures show that over 1,100 foreign financial institutions (37 % of all financial institutions with payments traffic in China or Hong Kong) already use the yuan.

Yuan deposits in Hong Kong, Singapore, Seoul and Taipei

Sources: Macrobond, BIS, national central banks and BOFIT

(*Singapore data available on a quarterly basis up to 2016Q1)