BOFIT Weekly Review 22/2016

Chinese share prices stable

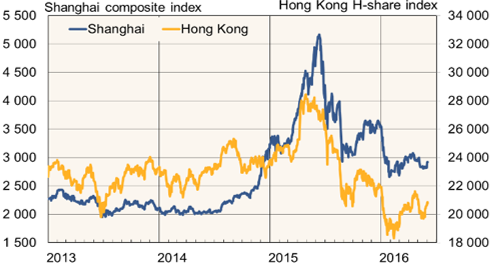

During last summer’s stock market crash, state measures to support share prices included encouraging market participants to buy copious amounts of shares with the requirement that they hold them for at least six months. As the ban on selling began to expire around the start of the year, share prices started to plunge again and officials decided to extend the ban on selling for large shareholders by limiting divestment of a firm’s shares to 1 % per quarter. After the measure, share prices have remained relatively stable for the past four months.

In the view of many investors, arbitrary and prolonged interruptions to share trading have become a big problem. China’s stock exchanges announced new rules in May that make it harder for firms to suspend trading and to limit trading breaks to defined periods, which are up to 3 months. The change coincides with the upcoming decision of Morgan Stanley Capital International on whether to include Chinese A-shares in its emerging market index (MSCI EM), which currently only includes shares of Chinese companies listed on the Hong Kong stock exchange. MSCI will announced its decision within the next two weeks. If A-shares are included, foreign ownership of China’s stock exchanges will probably increase, as it is mandatory for funds that track the MSCI EM index to purchase A-shares. Foreign investment in Chinese stock exchanges is currently only a few per cent.

Chinese share price trends in Shanghai and Hong Kong

Source: Macrobond