BOFIT Weekly Review 18/2016

CBR keeps key rate unchanged at 11 %

The Central Bank of Russia stated that inflation has slowed down in recent months, but inflation risks remain elevated. Hence, the CBR board of directors decided to keep the key rate at 11 %. The CBR estimates that 12-month inflation at the end of April was 7.3 %, unchanged from the March reading. The board said it expects to reach its declared 4 % inflation target in late 2017.

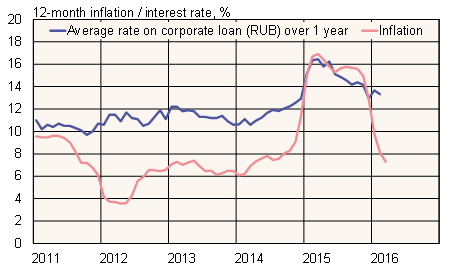

The CBR noted that uncertainty associated with government budgets was among the biggest inflation risks. In addition, it expects market interest rates to fall even without a cut in the key rate as the budget deficit and financing the shortfall out of the Reserve fund will increase liquidity in the banking sector. Lending rates have been falling gradually during the past year, but real interest rates have turned clearly positive this year due to the significant drop in inflation.

The CBR said it will resume a gradual lowering of the key rate in the near future if inflation risks subside sufficiently. The board’s next meeting on rates is set for June 10.

Average interest rate on corporate loans and inflation in Russia

Source: Macrobond.