BOFIT Weekly Review 17/2016

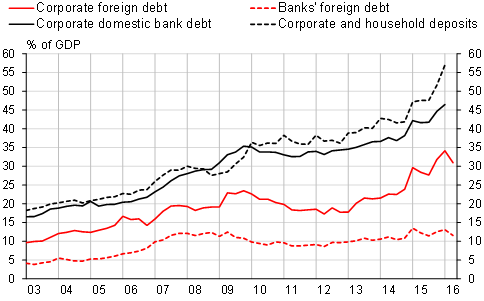

Little overall change in foreign debt of Russian firms and banks

The debts have gradually subsided since summer 2014, when foreign financial sanctions were imposed. The reduction tapered off in the first quarter, so that as of end-March the debt stood at $475 billion (under the recently applied GDP methodology over 35 % GDP; or over 40 % of GDP under the old method). Of that, corporate debt stood at $346 billion (over 25 % of GDP). In contrast to 2014 and 2015, the ruble’s exchange rate has had little impact on dollar value of the ruble-denominated part of foreign debt this year.

Repayment of foreign debt by Russian banks has gradually fallen. In the first quarter of this year, the repayments amounted to not much more than a few billion dollars. Banks have paid off their loans as earlier in amounts not very far from their scheduled payments. Their foreign receivables have also diminished. On January 1, they amounted to $222 billion (of which $91 billion were short-term receivables). For over a year now, the repayment capability of banks has been bolstered by growth in domestic deposits.

As earlier, firms managed in the first quarter to keep their foreign debt repayments at a minimum. The foreign receivables of Russian firms remained at over $200 billion (of which about $70 billion were short-term receivables). Due to the small amount of foreign debt repayments, the need for companies to offset foreign debt with domestic borrowing has remained small.

Foreign and domestic debt of corporations and banks

Source: Central Bank of Russia