BOFIT Weekly Review 16/2016

Fixed investment sustained China’s first-quarter growth

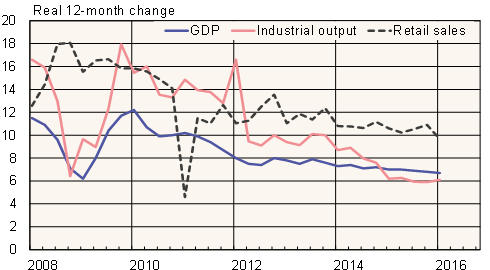

On-year GDP growth in January-March was 6.7 %. Seasonally adjusted quarterly growth, however, was 1.1 %, which translates to on-year growth of just 4.5 %. Nominal GDP growth of 7.1 % exceeded real GDP growth, signalling a pick-up in inflation. Nominal growth in 2015 overall was lower than real growth.

Looking at 1Q16 GDP supply items, industrial output (33 % of 1Q16 GDP) was up 6 % y-o-y, while construction activity (5 % of GDP) and the service sector overall (57 % of GDP) showed growth of 8 %. Of the services, growth in financial sector (10 % of GDP) slowed from 16 % y-o-y in 1Q15 to 8 % in 1Q16 and growth of real estate services (7 % of GDP) accelerated to 9 %.

Fixed investment towered over other demand-side components in the first quarter, climbing 14 % y-o-y in real terms. Investment in infrastructure notably increased 20 %. Public investment was the big driver of higher investment growth with investment of government and state-owned enterprises up over 23 % y-o-y in nominal terms. Public investment accounted for 34 % of fixed investment in 1Q16 (up from 30 % in 1Q15).

Borrowing to finance investment remained brisk in January-March with growth in the loan stock continuing to climb at around 15 % y-o-y. It appears that China has reverted to the traditional approach for hitting the annual official growth target (6.5–7 % this year) – bank-financed investment. The risk with this strategy is that it leaves no space to subdue the growth of indebtedness.

Growth in retail sales, an indicator of private consumption trends, remained at 10 % in the first quarter. Real per capita incomes grew at an on-year pace of 7 %. The National Bureau of Statistics also hinted that the unemployment rate in March was 5.2 %, even if the bureau hasn't yet published the survey-based unemployment statistics.

Growth trends in GDP, industrial output and retail sales, %

Source: Macrobond