BOFIT Weekly Review 14/2016

Higher oil prices lift ruble’s exchange rate

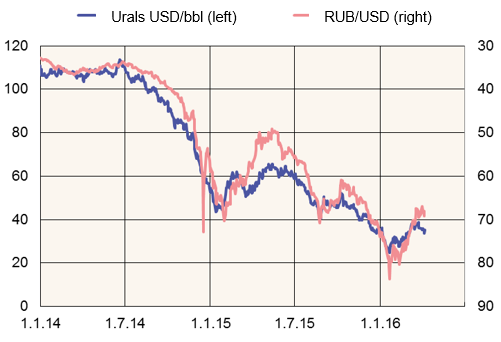

The rising price of Urals-grade crude oil since January has also boosted the ruble’s exchange rate. On Thursday (Apr. 7) the price of Urals crude was $36.5 a barrel (Brent $38.7). Since hitting this year’s low on January 21, the price of Urals crude has rebounded by 48 %. In the same period, the ruble has appreciated 23 % against the dollar. The ruble’s appreciation has been further supported by the usual first-quarter effect of the large amount of corporate taxes coming due at the end of March. On Thursday (Apr. 7), one dollar bought 67.9 rubles and one euro 77.4 rubles.

Since July 2015, the Central Bank of Russia has avoided direct interventions in the currency market to influence the ruble’s external value. The value of the CBR’s gold and foreign currency reserves also climbed in January-March from $368 billion to $387 billion, mostly on the increase in the value of the CBR’s gold reserves from $49 billion to $58 billion. The value of the CBR’s foreign currency reserves also rose from $320 billion to $329 billion.

12-month consumer price inflation slowed to 7.3 % in March, due e.g. to the ruble’s appreciation and the fact that March 2015 provided a high base level.

Urals oil price and ruble-dollar exchange rate

Source: Reuters.