BOFIT Weekly Review 13/2016

No big changes in China’s fiscal policy in 2016

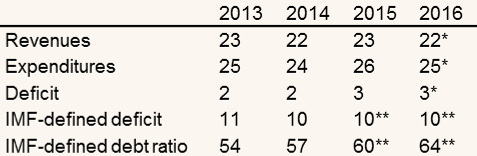

Growth in government spending overall (central and local level) should nearly match GDP growth this year and reach 18 trillion yuan. Growth in government revenues, in contrast, looks to grow just 3 % this year. Part of the reduced revenue stream reflects expansion of a value-added tax pilot programme that allows firms to deduct more taxes than earlier. The consolidated government budget deficit this year should be about 2.2 trillion yuan, or roughly 3 % of GDP.

Although China has sought to improve public sector reporting, the latest budget report to parliament leaves open many questions about the structure and trends from revenues and spending. The report itemises various areas of priority, but says little about how budgeted assets will actually be spent. In any case, the plan seems to be rise spending quite evenly across the board of public sector activity.

China’s budget practices do not follow international standards and local governments, in particular, operate extensively off-budget. To get a clearer picture of Chinese conditions, the IMF has begun to release its own figures on China’s public economy that includes off-budget activity. The IMF figures suggest the annual public sector deficit has been running at about 10 % of GDP since 2009 and is on track to show a similar deficit this year. The IMF further estimates that more broadly defined public-sector debt is already about 60 % of GDP.

China’s public sector finances (central and local governments), % of GDP

* Nominal GDP projected to rise 6 % this year. ** IMF estimate.

Sources: CEIC, China’s budget report and IMF.