BOFIT Weekly Review 13/2016

Chinese firms struggle with late payments and debt

Bloomberg News reports that Chinese firms are waiting longer for their customers to pay their bills. The median time for getting the money after sales has risen by a month in five years to 83 days, an average delay in payments not seen since the late 1990s. The slowest payers by sector are found in industry, where the median time to receive payment is 131 days after the sale.

The extended delay in payments, along with weaker profitability and outlook, has raised concerns about the ability of companies to service debt in a timely manner. Banks have seen an increase in nonperforming loans and in recent weeks, also central bank governor Zhou Xiaochuan has begun to warn of a debt problem. The Bank for International Settlements (BIS) reports that Chinese firms have taken on exceptionally large amounts of debt compared to companies in any other countries.

To reduce corporate debt burdens, premier Li Keqiang has proposed that companies having trouble paying their loans could pay them with their shares. Banks have low enthusiasm for the proposal, however, because it would make them owners of their debtors’ problems. In any case, the issue is no longer hypothetical: struggling shipbuilder Huarong Energy last month swapped $2.7 billion in debt for its shares. The company’s creditors now own a 90 % stake in a company that in 2014 lost over a billion dollars in an industry struggling with overcapacity. When the equity-for-debt swap was last used to mop up the effects of the Asian financial crisis, commercial banks were generously recapitalised by the government.

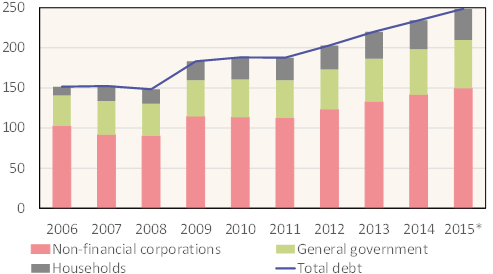

China’s debt structure, % of GDP

Sources: BIS and IMF. Public sector debt includes local government off-budget investment vehicles. * BOFIT estimate