BOFIT Weekly Review 12/2016

BOFIT sees continued modest slowdown in growth for China

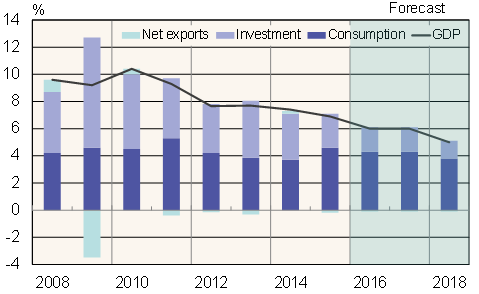

Despite market fluctuations, our latest BOFIT Forecast for China sees China’s development in coming years conforming largely to our earlier forecasts. Thus, we expect the Chinese economy to grow at around 6 % p.a. in 2016 and 2017, and then slow to around 5 % in 2018.

The rate of structural change accelerated last year and Chinese economy seems to be even more clearly following dual tracks. Growth in the service sector remains brisk, contributing to the relatively bright outlook for employment. In contrast, heavy industry production declines and branches suffering from overcapacity will be forced to reduce output. In coming years, growth in fixed investment will moderate and China’s domestic consumption will increasingly drive economic growth.

A controlled slowdown in economic growth and a smooth progress in structural change is by no means a given. With the opening of China’s markets to the world and an already high level of indebtedness, the economy is increasingly susceptible to a range of economic disruptors. China’s overall debt-to-GDP ratio is estimated to be around 250 % of GDP, which is exceptionally high for countries at a similar level of development. If the high GDP growth targets under the current five-year plan are adhered to, China will be left with little room to work on reducing debt. The risk of allowing problems to build up is that progress in needed reforms will take a back seat as decision makers are tempted to increase regulation and leverage to prop up existing economic structures and non-competitive heavy industry, especially at the regional level. Indeed, some signs of tighter regulatory policies that are ill-suited to economic reform efforts have recently begun to appear.

Structure of China’s economic growth and BOFIT forecast

Sources: China National Bureau of Statistics and BOFIT

The opening up of the Chinese economy brings with it new risks that will have to be met with well-defined policy measures and transparency. Deregulation of capital movements and the freeing of the yuan’s exchange rate should proceed at a deliberate pace to take advantage of the relatively favourable conditions at the moment. Postponing reforms could leave policymakers in a position where they must push through tough reforms in the midst of a crisis.