BOFIT Weekly Review 12/2016

Latest BOFIT forecast for Russia sees economy and imports still contracting further this year

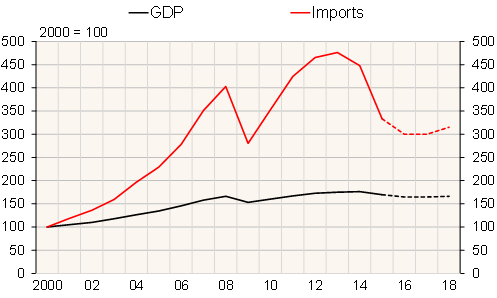

With the price of oil down by about 50 % in the second half of 2014, domestic demand, including private consumption, slid 10 % last year. Russian GDP contracted 3.7 %, even if oil sector exports displayed strong growth and defence spending rose at record pace. Imports fell by 25 % (down 6 % in 2014) on Russia’s falling export earnings and the weak ruble.

The oil price slipped again in the second half of 2015. The latest BOFIT Forecast for Russia for 2016–2018 assumes the oil price recovering only slowly, to an average price this year slightly above $40 a barrel (23 % less than in 2015) and $49 a barrel in 2018. We assume no change in geopolitical tensions or economic sanctions. Due to the previous export price shocks and also the oil price assumption, we see Russian GDP contracting about 3 % this year and then remaining around zero in 2017 before returning to low growth. Russian growth should remain low thereafter due to uncertainties and the poor quality of the business environment.

Because the economy will contract and Russian export earnings fall, Russian imports are expected to contract this year yet another 10 %. The volume of imports would be about 37 % below their 2013 level. With recoveries in the economy and export earnings, we expect imports to return to modest growth towards the end of the forecast period. The ruble’s real exchange rate will appreciate gradually as inflation remains higher in Russia than in its main trading partners.

The substantial further decrease in domestic demand this year will be driven by several factors, including still rather high inflation that continues to eat away at purchasing power in the private and public sectors. Private consumption will also be restrained by modest growth in private and public sector wages, as well as small pension hikes. Fixed investment is expected to continue to decline. The volume of exports will rise only slowly as growth in oil sector exports will fade.

Russian GDP and import volumes

Sources: Rosstat and BOFIT Forecast for 2016–2018.

Even without targeted cuts, real government spending is set to decline notably this year. The oil price drop has reduced the government’s real revenues sharply, so the government also this year faces a rather large budget deficit.

The oil price is a central risk to the forecast, as it could go up or down from our assumption. Geopolitical tensions could change, and there is continuously the risk of other events that would increase capital flows from Russia and cause the ruble and imports to deteriorate further. Despite the government’s aims to cut spending, the government could add to spending as the September 2016 Duma elections and March 2018 presidential election are approaching.