BOFIT Weekly Review 10/2016

Consumption down across Russia in 2015

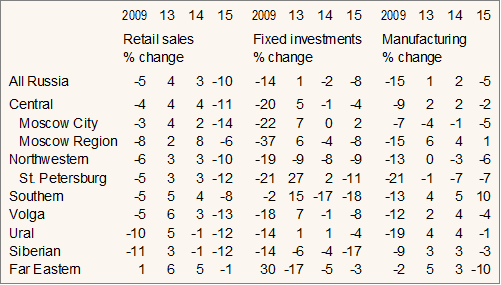

Retail sales volumes fell 8–13 % in six of Russia’s federal districts, a significantly larger drop than in the 2009 recession. Of Russia’s 83 administrative regions, 27 experienced declines in retail sales of 10–15 % and five saw drops of 15–20 %.

Fixed investment fell most in the Southern and Siberian Federal Districts. The Northwestern Federal District also experienced a large decrease, for the third year in a row. There were huge differences across administrative regions. 39 regions saw fixed investment slump at least by 10 %, including 15 regions with drops of 20–30 % and six regions with drops of 30–40 %. Investment rose by over 5 % in six regions.

Production in extractive industries (including oil & gas as its major part) largely avoided very significant decreases in major production areas as well as regions where extractive industries constitute a large share of the economy. Manufacturing output was down most in the Far Eastern Federal District and the Northwestern Federal District. With respect to the largest regions in terms of their share of manufacturing in Russia, tangible production declines were only seen in Moscow and St. Petersburg. In smaller manufacturing regions, nine saw manufacturing production contract about 8 % and twelve regions saw declines of over 10 %.

Real growth in core economic indicators for seven federal districts and Russia’s main urban centres, 2009 and 2013–2015

Source: Rosstat