BOFIT Weekly Review 08/2016

Russian manufacturing shrank 5 % last year

The production of basic necessities seems to be performing best among manufacturing branches. The ruble’s devaluation has boosted prices of imported goods, forcing consumers to switch to domestic products. Food industry output was up by 2 %, and was further supported by earlier investment and import bans. In contrast, the textile industry has seen little benefit from the ruble’s devaluation or import restrictions on state procurement. The textile industry’s production fell by 12 % last year.

Pharmaceutical production was also up 9 %. There are, however, increasing concerns in Russia about the availability of some of the cheapest medicines. Their prices are controlled by the state, which reduces incentives for companies to produce them. The chemical industry overall grew by 6 %. The chemical industry’s robust growth might have also been partly due to the notable increase in defence spending last year, supporting e.g. production of explosives.

Increased exports helped oil refining record slight growth. Due to weak domestic demand for petroleum products, 60 % of refined products went to export last year. Export volumes of many metals and wood products increased on the weak ruble, even if output of metal industry contracted nearly 7 % and the forest industry about 5 %. Global price drops have, however, hit the sales value of metal producers.

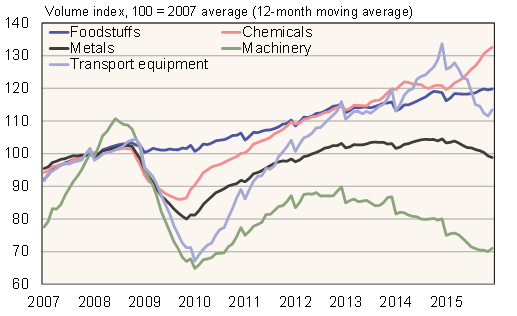

Branches that rely mostly on domestic investment demand are suffering at the moment. Production of construction materials contracted 8 % last year, while manufacturing of machinery, equipment and transport vehicles was down 10 %. The production of transport equipment has been dragged by the shrinking car sales in Russia as they were down already third year in a row. Last year’s drop was intensified due to the record-high production level in 2014, which was fuelled by a significant increase in defence spending.

The manufacturing outlook for this year is hardly rosy. Domestic demand remains weak and rapid inflation erodes the price competitiveness brought by the weaker ruble. The ruble devaluation has also hurt the profitability of some firms as prices of imported components have risen notably. The lack of investment could suppress production growth for a long time. Manufacturing investment in Russia in recent years has only corresponded to about 2.5 % of GDP.

Russian industry remains heavily focused on oil & gas production, and no signs of diversification in the production structure has been seen in recent years. Also within the manufacturing sector, oil refining is the largest branch. Other manufacturing production accounts for about 10 % of Russian GDP. The next-biggest branches are foodstuffs, machinery, equipment and transport vehicles, as well as the metals industry.

Trends in some manufacturing branches in Russia

Sources: Rosstat, BOFIT.