BOFIT Weekly Review 07/2016

China’s lending soars, while share of nonperforming loans increases

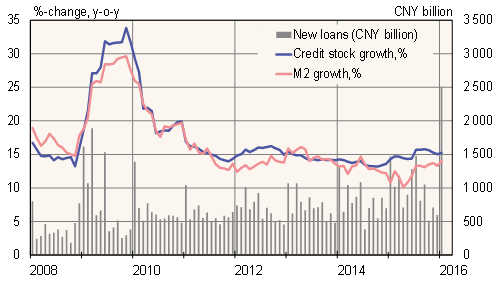

Some 2.5 trillion yuan ($380 billion) in new yuan-denominated loans were granted in January – more than in any single month ever. The amount was comparable to the combined value of lending last year in both January and February. The corporate sector (including public-sector businesses) borrowed 1.94 trillion yuan, an increase of 85 % from January 2015. New lending to households in January amounted to 610 billion yuan (up 43 % y-o-y). The total credit stock grew 15 % y-o-y in January.

Lending usually surges at the start of the year due to high seasonal demand for money around the Chinese New Year’s holiday week. This year, the growth in demand for yuan-denominated credit also reflects a fall in demand for foreign-currency loans and efforts to pay off foreign-currency debt. In January, the People’s Bank of China stepped up its money supply expansion efforts through open-market operations and the use of targeted lending. Growth in the broad money supply (M2) accelerated to 14 % y-o-y in January.

Consumer price inflation accelerated to 1.8 % in January. Core inflation (excludes prices of food and energy) remained at 1.5 %, while producer price deflation reached 5.3 % in January.

The volume of non-performing loans (NPLs) on bank balance sheets rose in 2015. The banking sector’s NPL stock amounted to 1.3 trillion yuan. When ‘special mention loans’ (a high likelihood of default) are included, the total amount rises to 4.2 trillion yuan ($650 billion), an increase of 41 % y-o-y. NPLs and special mention loans combined represented on average 5.5 % of the banking sector’s total credit stock.

Loan-loss provisions on bank balance sheets amounted to 2.3 trillion yuan (up 18 %) at the end of 2015 – an amount sufficient to cover 180 % of total NPLs. Under current regulatory rules, bank need to hold loan-loss reserves equivalent to at least 150 % of their NPL stock. Media reports say a cut of loan-loss provision requirement is under consideration to help banks improve their profitability.

Growth in credit stock and money supply (M2), new yuan loans

Sources: Macrobond, Bloomberg.