BOFIT Weekly Review 6/2016

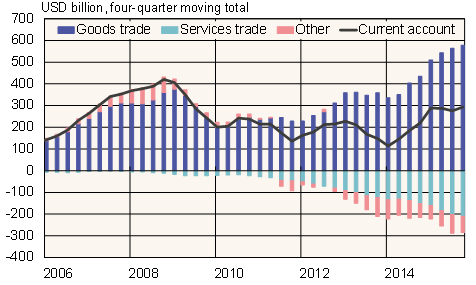

China’s current account surplus grew last year

Preliminary balance-of-payments figures show China’s 2015 current account surplus amounted to $293 billion, or 2.7 % of GDP. The goods trade surplus of $578 billion was partly offset by deficits in the services trade balance and income transfers. The services trade deficit of $209 billion was generated almost entirely by Chinese travellers, who spent $253 billion abroad last year compared to $165 billion in 2014.

The counterpart of the current account in balance of payments includes the capital account, financial account and the net errors and omissions term. Taken as a whole, they indicate that net capital outflows continued last year through both official and unofficial channels. Preliminary figures do not break out the net errors and omissions term from the rest of the financial account balance, however. Some capital outflows reflect normal business activity such as Chinese direct and portfolio investment abroad. Moreover, firms worried about currency risk and yuan depreciation seem to have accelerated payments on principal of their loans denominated in foreign currencies.

The value of China’s foreign currency reserves shrank by $513 billion last year. Some $170 billion of that reflected shifts in exchange rates and asset valuations. The value of currency reserves fell $99 billion last month to $3.231 trillion. Total reserves (including gold, SDRs and reserves held by the IMF) were worth $3.308 trillion as of end-January.

Trends in Chinese current account components

Source: Macrobond.