BOFIT Weekly Review 05/2016

Reforms to Chinese exchange rate policy expected

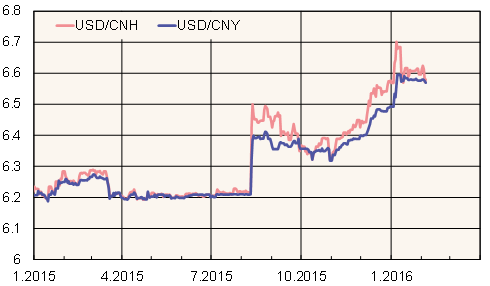

The yuan started the year by weakening almost 2 % against the dollar, but since then the People’s Bank of China has kept the yuan-dollar rate fairly stable. In past two weeks, off-shore yuan trading in Hong Kong (CNH) saw the yuan weaken against the dollar widening the gap between the CNH and on-shore mainland yuan (CNY). On Thursday (4th of Feb), the gap almost closed pointing again to an intervention by the Chinese authorities.

The government has employed stricter capital controls to contain capital outflows from the country. Press reports say PBoC measures include limiting the sale of bonds by foreign institutions on the interbank market and urging commercial banks to limit customer attempts at moving yuan assets out of the country. Additionally, the granting of new foreign investment quotas for qualified domestic institutional investor (QDII) and renminbi qualified domestic investor (RQDII) programmes have been on hold since March 15.

Since January 25, the reserve requirement have been applied also to deposits in Hong Kong and other yuan trading centres, thereby increasing costs of yuan trading. As the possibility of investing in yuan-denominated assets outside mainland China is limited, foreign banks often simply deposits their yuan in mainland China banks. Mainland China banks operating in Hong Kong have also been instructed to cease offering off-shore interbank loans, rising interest rates substantially in Hong Kong at times.

Some economists have recently recommended stricter limits on capital movements as a cure for the falling yuan exchange rate. China’s economy and financial system, however, have opened to such an extent that restricting capital outflows is now difficult and contradicts the country’s strategy of opening up. In lieu of stricter capital controls, China needs to find a way to shift to a more flexible approach to exchange rate formation. A more flexible exchange rate would allow deregulation of capital movements to continue, but would also demand clearer domestic monetary policy.

On-shore CNY (Mainland China) and Off-shore CHN (Hong Kong) yuan-dollar rates

Source: Macrobond