BOFIT Weekly Review 01/2016

Volatility of yuan exchange rate increases as system overhaul proceeds

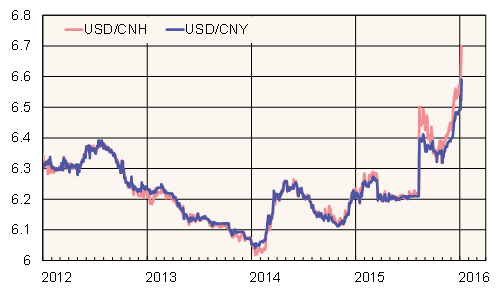

Nervousness this week also seized the foreign exchange markets. On Thursday (Jan. 7), the yuan-dollar rate was down 1.5 % from the start of the year in Shanghai and down 1.7 % on Hong Kong’s forex market. Since the mini-devaluation last August, the yuan has stayed consistently weaker in Hong Kong than in mainland China, suggesting that depreciation pressure on the yuan has increased considerably since August.

While the main reason for the weakening pressure is the uncertainty stemming from the slowdown in economic growth, the trend on the forex market also reflects changes in the foreign exchange rate system itself. Last August, in connection with the yuan’s mini-devaluation, the People’s Bank of China announced that its calculation of the daily dollar-fixing rate would be adjusted to better reflect actual market conditions. In December, the PBoC published 13 core currency partners in its composite CFETS currency index, designed to give a wider insight into the yuan’s trend than the dollar-yuan rate alone. While publication of the index carries the possibility that volatility in the yuan-dollar rate could increase, its role in actual policy making is still unclear. The latest change came this week as the opening times of China’s forex markets was extended so that trading in Shanghai concludes at 11.30 pm instead of 4.30 pm as earlier. The change is expected to smooth yuan trading on Chinese and European markets.

Although the recent weakening of the yuan has shaken markets, increased yuan exchange rate volatility is part of a normal system adjustment and a sign that China is developing in the direction of advanced economies. The Chinese economy has evolved to such an extent that its relatively tight foreign exchange rate policy would be too costly to pursue and, hence, more flexible rates are needed. The shift is not straightforward, however, as the country will occasionally revert to traditional methods in rate setting. Late last year, for example, some foreign banks were temporarily forbidden to make certain forex operations to prevent arbitrage of exchange rate differences on the Shanghai and Hong Kong yuan markets.

Mainland and Hong Kong (offshore) yuan-dollar rates

Source: Macrobond.