BOFIT Weekly Review 01/2016

Russia’s banking sector weakens

The troubles of the real economy are beginning to manifest in banking sector performance. While banks overall are still profitable, the number of loss-making banks rose notably in the first eleven months of 2015, with nearly 30 % of banks operating in the red. Growth in delinquent payments and credit losses are one factor in this shift. The volume of delinquent loan payments rose by almost 50 % in January-November 2015. At the start of December, delinquent payments of Russian firms and households reached 2.63 trillion rubles, or to nearly 7 % of the stock of granted credit. So-called problem loans, which represented less than 7 % of the total loan stock at the start of the year, exceeded 8 % by the beginning of November.

Boosted by considerable government support, the average ratio of bank’s own capital to total assets in the banking sector has risen to 13 %. There are large variations, however. At the beginning of November, 129 banks had equity ratios below 12 %. Large deficiencies in calculating the capital have come to light in several bank insolvencies.

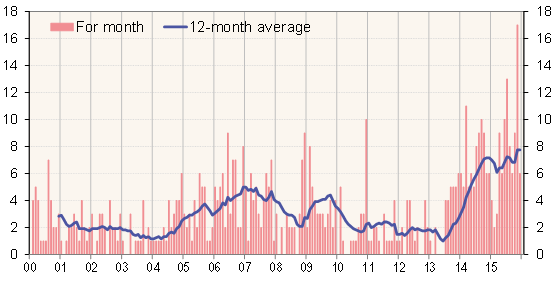

The CBR has increased its efforts to clean up the banking sector. Since June 2013, over 200 credit institutions have lost their licenses (93 in 2015). Most of the banks have been covered by the deposit insurance scheme. Consolidation of the banking sector continues, and today Russia’s 20 largest banks hold about 75 % of all banking sector assets. At the beginning of December, 740 banks operated in Russia.

Number of banking licence cancellations in Russia, 2000–2015

Source: Banki.ru.