BOFIT Weekly Review 52/2015

China’s trade surplus fairly stable with commodities removed

With the slowdown in China’s economic growth, the debate over the country’s price competitiveness and exchange rate policy has heated up. The trade balance trend is an important indicator in considering these issues.

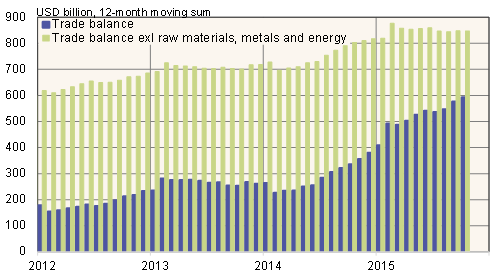

China’s overall trade surplus has soared this year, with the trade surplus for the first ten months of the year reaching $490 billion, a rise of nearly 80 % y-o-y. Metals, energy and other commodities last year accounted for nearly 40 % of the value of China’s imports. Their share of imports has fallen slightly along with lower commodity and energy prices. They also only represent slightly over 10 % of China’s exports. As commodity prices do not tell about China’s competitiveness, it is interesting to consider Chinese balance-of-payments figures with commodities trade removed entirely.

The January-October trade surplus stripped of metals, energy and other commodities was up just 5 % y-o-y. This year the running 12-month trade surplus without commodities has stayed largely unchanged. Thus, the trade balance trend with commodities excluded does not indicate any large changes in China’s external balance or competitiveness.

China’s overall trade balance and trade balance with metals, energy and other commodities removed

Sources: CEIC, BOFIT.