BOFIT Weekly Review 49/2015

Yuan will join IMF’s SDR basket

On Monday (Nov. 30), the IMF executive board voted to add the yuan as its fifth currency in its Special Drawing Rights (SDR) valuation basket. The incorporation of the yuan will officially take place on October 1, 2016. The yuan’s weighting in the updated basket will be 11 %, with the US dollar maintaining it weighting of 42 %, and smaller weightings for the euro (from 37 % to 31 %), Japanese yen (9 % to 8 %) and the British pound (11 % to 8 %).

The IMF’s decision, above all, is a symbolic acknowledgement of China’s recent economic policies and the country’s opening to the world. The People’s Bank of China has promised to continue with reforms. SDR status does not directly influence the international attractiveness of yuan-based investments or use of the yuan in foreign trade. Rather how the yuan is perceived as a store of value is affected by China’s economic development and how well China creates a balanced, predictable market environment.

The SDR is an international reserve asset available to help IMF member countries boost liquidity, so part of each member states’ reserves is denominated in SDRs. At the end of November, a total of 204 billion SDR units (about $280 billion) had been allocated to IMF member states. The introduction of the yuan will impact IMF rate of lending and the rate paid on SDR deposits (weighted average of SDR basket to the national short-term interest rate).

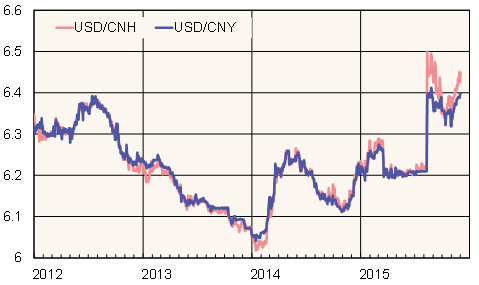

The decision was expected. Markets barely reacted to the board’s Monday announcement as IMF managing director Christine Lagarde had earlier declared her support for adding the yuan in the SDR basket. Since China’s exchange rate reforms this summer, the yuan has faced depreciation pressure with the offshore yuan persistently trading in Hong Kong at a discount to the mainland rate. Many market participants expect the PBoC to let the yuan depreciate further after the SDR decision. The PBoC, however, has given assurances that it will hold the exchange rate steady and only intervene in the markets to mitigate exceptionally large shifts in capital flows.

Mainland yuan-dollar (CNY) and Hong Kong offshore (CNH) exchange rates

Source: Macrobond