BOFIT Weekly Review 48/2015

Chinese monetary policy is in search for a new framework

While interest rates were permanently freed in October and the People’s Bank of China is on a path to market-based monetary policy, how the new monetary policy approach will be implemented is still unclear. There is no central bank policy rate yet. According to media reports, the PBoC will introduce an interest rate corridor to guide market rates. The floor of the proposed band would likely be the central bank’s offered rate for banks’ excess reserves, while the ceiling would be the short-term rate for its standing lending facility (SLF).

The rate paid on excess reserves has stood at 0.72 % since late 2008. While little data on SLF rates is available, the PBoC in November mentioned on a social media account that it had lowered SLF rates for smaller banks. For example, the rate on the seven-day credit for local banks was 3.25 %. Information about earlier rate levels was not revealed. The workings of the SLF are hardly transparent, so it could not form an effective reference rate at the moment. SLF lending is not implemented frequently as e.g. open market operations. The PBoC has not conducted any SLF lending since last April.

The PBoC sets several interest rates, including benchmark rates for commercial bank loans and deposits, interest rates paid on mandatory and excess reserves of banks with the central bank, as well as rates used in open market operations (e.g. repo rates). Since 2013, China has launched a number of central bank lending instruments. Besides the SLF, the PBoC has rolled out a medium-term lending facility (MLF), a facility for targeted lending called “pledged supplementary lending” (PSL) and the short-term liquidity operation (SLO) to cover possible brief episodes of liquidity stress.

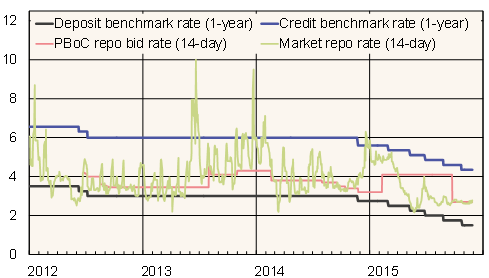

Interest rate trends, 1.1.2012–27.11.2015 (%)

Source: Macrobond

The PBoC discloses details on the use of the new lending instruments and applied interest rates only weeks or months afterwards. Transparency of these instruments needs to improve significantly, if they are to be used as tools in monetary policy communication. During the transition period, PBoC benchmark rates will provide important guidance for pricing by commercial banks and serve as a means of communicating the monetary policy stance. Reserve requirements, however, will remain the main policy tool until the shift to an interest rate policy is completed.