BOFIT Weekly Review 47/2015

Foreign direct investment flows to China on the increase

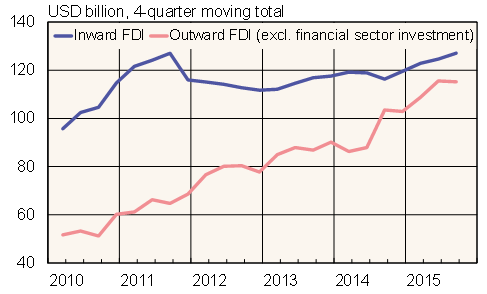

Figures released by China’s commerce ministry show that foreign direct investment into China in the first ten months of this year amounted to $104 billion, an increase of 8 % y-o-y. After several years of slack growth, inward FDI this year were up significantly. Most FDI to China are channelled via financial centres or tax havens, so the true country of origin does not show up in bilateral figures. Aside these investments, the biggest FDI sources were South Korea, Japan, the United States and Germany.

The volume of new outward foreign direct investment (OFDI) from China (excluding financial sector investments) in January-October was $95 billion. Investment has increased 11 % y-o-y, even if investment in the third quarter was about the same as in 3Q14. In 2014, 70 % of China’s OFDI went to Asia, 9 % to Europe, 9 % to South America and 7 % to North America. The largest part of China’s OFDI goes to financial centres such as Hong Kong or tax havens such as the Cayman Islands. Again, the ultimate destination of investments cannot be discerned from official figures and some investments may be recycled back to mainland China.

Interpretation of Chinese FDI figures is further complicated by the fact that official figures published by the commerce ministry only include approved new investments. The figures lack data on repatriated investments and thus the net flow of investments. Balance-of-payments FDI data are also suspect. For example, net OFDI has remained flat for several years now. Given that Chinese investments in e.g. Europe and North America have targeted branches where investments are by their nature extremely long term, it is quite unlikely that repatriation of Chinese investment has grown at the same rate as the volume of new investment.

Foreign direct investment flows to and from China

Source: China’s Ministry of Commerce