BOFIT Weekly Review 46/2015

Mainland China share prices soar again; CSRC lifts moratorium on IPO listings

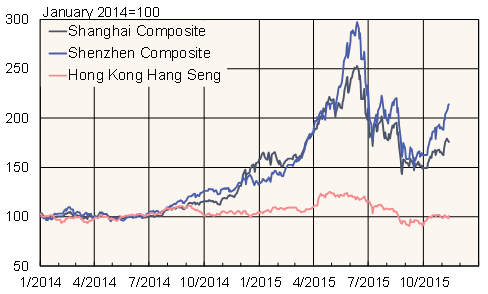

Share indexes in October were up 11 % on the Shanghai stock exchange and 17 % on the Shenzhen exchange – and the upward trend has continued in recent weeks. Even with last summer’s stock market collapse, prices of mainland China shares are up about 50 % from a year ago. The price-to-earnings ratio (P/E) is up again, averaging 17 in October for firms listed on the Shanghai exchange and 45 for companies on the Shenzhen exchange. Banking-sector firms, which have a large weighting of shares on the Shanghai exchange, currently have an average P/E ratio of 8. In contrast, the P/E values are much higher for other sectors, for example manufacturing firms (average 37), commerce (37) and information technology (68).

On the Hong Kong stock exchange stock prices are lower than they were a year ago. The difference in prices between Shanghai and Hong Kong stock exchanges has widened, despite the fact that the Stock Connect programme, which in principle permits arbitrage between the exchanges, has been in place for a year. The prices of shares of firms listed on both exchanges are currently about 40 % higher on the Shanghai exchange than in Hong Kong.

The China Securities Regulatory Commission (CSRC), which oversees stock markets in mainland China, said it would begin to allow initial public listings starting November 20. The CSRC also said it would no longer require that shares must be paid for in full upon subscription. The practice has caused severe drops in market liquidity whenever IPOs occur. Chinese IPO share prices typically soar immediately after listing and thus IPOs tend to be heavily oversubscribed and shares are allocated by lottery.

The CSRC halted IPOs in July as Chinese stock markets plunged. With markets on the rise, IPOs will again be permitted. Firms approved for IPOs before the interruption will go first. During the first part of this year, more IPOs were approved than before. Over 170 firms staged IPOs on the Shanghai and Shenzhen exchanges in January-July, raising a total of 147 billion yuan (€20 billion), over twice the amount for all of 2014. Hundreds of firms currently await their IPOs.

Stock market index trends (Jan. 1, 2014 – Nov. 12, 2015)

Sources: Macrobond, BOFIT