BOFIT Weekly Review 46/2015

Russian foreign trade remains very weak

The value of Russian goods exports in the third quarter was down nearly 40 % y-o-y in dollar terms and about 25 % in euro terms. Low export prices were largely responsible for the drop. The price of Urals-grade crude oil hit its lowest level since early 2009. Third-quarter growth in crude oil export volumes also slowed from the first half to 5 % y-o-y, while exports of petroleum products contracted 12 % after strong growth in the first half of the year. In contrast, the volume of natural gas exports picked up sharply in the third quarter after shrinking in the first half. Exports to nearly all of Russia’s trading partners were down, but exports to countries where oil plays a smaller role, e.g. the Eurasian Economic Union (EAEU) and the US, were off considerably less.

The value of goods imports in July-September fell about as fast as the value of exports. The contraction in imports was broad-based, with falling demand and the weak ruble affecting nearly all product groups and markets. Economic sanctions did not play a crucial role in the overall reduction in imports. Imports from EAEU countries, however, have been supported since late August by sharp depreciation of the Kazakhstan tenge and the Belarus ruble. In the largest product categories, the value of imports of machinery, equipment & transport equipment was down 40 % y-o-y, while imports of chemical products and foodstuffs each contracted by 30 %.

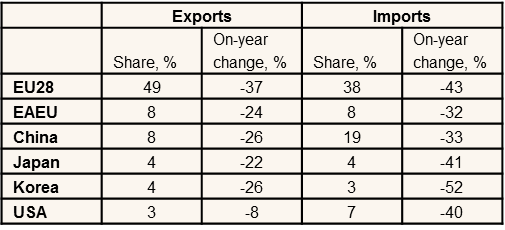

The value of Russian goods exports in the first nine months of the year amounted to about $260 billion, while goods imports were valued at roughly $140 billion. The structures of imports and exports in terms of countries and product groups have not changed significantly lately. Nearly half of exports consisted of crude oil and petroleum products. Natural gas accounted for about 15 % of exports, followed by metal and chemical products at about 10 %. Over 40 % of imports consisted of machinery, equipment & transport equipment, followed by nearly 20 % share of chemical products and nearly 15 % of foodstuffs. The EU as a whole was clearly Russia’s most important trading partner, while the single largest market in Russia’s foreign trade was China.

Russian foreign trade, January-September 2015

Source: Russian customs.