BOFIT Weekly Review 43/2015

Yuan weakened slightly in the late summer

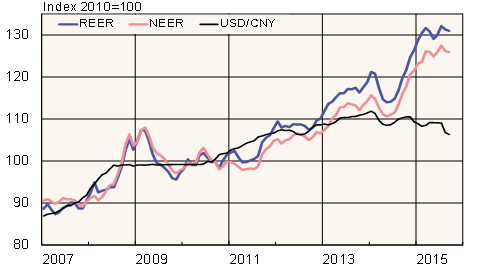

The real effective (trade-weighted) exchange rate (REER), which takes into account inflation differences between China and its main trading partners, was down 1 % in September from its July peak. Compared to a year ago, the REER was up 9 %. Similarly, the nominal effective exchange rate (NEER) strengthened in September by 9 % y-o-y, but weakened slightly from July. On Friday (Oct. 23), one dollar bought 6.36 yuan and one euro 7.06 yuan. Compared to a year ago, the yuan has weakened 4 % against the dollar and gained 9 % against the euro.

For years, complaints that China was deliberately undervaluing its currency were common. But after a long episode of yuan appreciation, most of this criticism has died down. Even the US treasury department has changed its view in this respect, commenting that the US no longer considers the yuan significantly undervalued. The treasury department notes, however, that the yuan’s exchange rate is still below its medium term valuation. The report sees yuan appreciation continuing over the long run, even though in the short run the yuan faces depreciation pressures on e.g. capital outflows driven by stock market volatility.

Yuan-dollar exchange rate; real (REER) and nominal (NEER) effective exchange rates

Sources: BIS, Bloomberg