BOFIT Weekly Review 35/2015

Falling oil prices weaken the ruble and increase risks to Russia’s economy

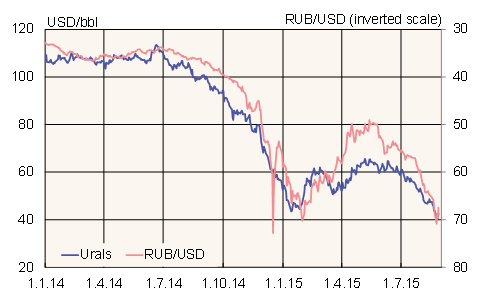

The ruble’s slide accelerated after the price of Urals-grade crude oil approached the $40 mark last week. The ruble has lost about a third of its value against the euro and dollar since its recent peak in late May. It hit new lows of the year this week. The currencies of other commodity-producing countries have also been affected. For example, oil-producer Kazakhstan last week announced of switching to free-float and saw the tenge drop over 20 % against the dollar.

Adding to depreciation pressures on ruble, nearly double the recent average monthly amount of private-sector foreign debt comes due in September. The Central Bank of Russia has, however, estimated that a large part of the debt is intra-group and could be refinanced. Prime minister Medvedev recently expressed his confidence in the ruble, saying the exchange rate should get a boost when exporter firms will sell additional forex proceeds in the near future. Medvedev added that the government has not relaxed its supervision of exporters’ sales revenues launched at the end of 2014.

The global drop in oil prices and anxiety on international financial markets was evident also on the Russian exchange this week as the RTS index fell to its lowest point this year.

Low oil prices forced the economy ministry to revise downward by a half percentage point its GDP forecasts for 2015 and 2016. In the new forecast, GDP shrinks 3.7 % this year, but next year grows 1.8 % (still optimistic compared to the consensus view) assuming an average oil price of $55 a barrel. If the oil price stays at $40 a barrel next year, the ministry sees GDP contracting 0.9 %.

Low oil prices also put pressure on the government for further fiscal tightening. The current 2016 draft budget assumes an average oil price of $60/bbl, an exchange rate of 57 rubles to the dollar and 2.3 % GDP growth. Even under these parameters, the 2016 federal budget deficit would still be 2.4 % of GDP. As part of its July budget calculations, the finance ministry also estimated that the Reserve Fund will correspond to 2.9 % of GDP at the start of next year.

Ruble-dollar exchange rate and price of Urals crude

Source: Reuters