BOFIT Weekly Review 34/2015

Turbulence continues on Chinese markets

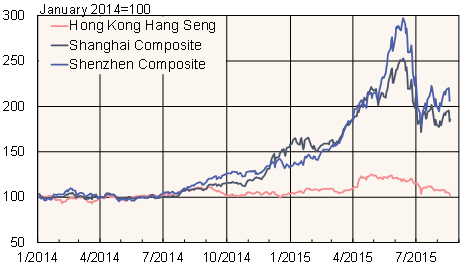

Uncertainty on Chinese stock markets persists despite official efforts to stabilise the markets. The stock market turbulence is due to e.g. increased volatility in foreign exchange markets and speculation that officials may withdraw stock market support. On Tuesday (Aug. 18), share prices plunged over 6 % on the Shanghai and Shenzhen exchanges, and the markets remain shaky.

Chinese share prices, 1.1.2014–19.8.2015

Sources: Macrobond, BOFIT

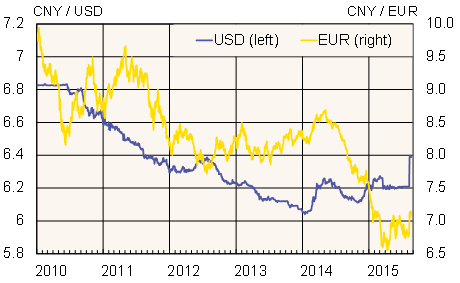

Uncertainty on foreign exchange markets increased last week after the People’s Bank of China shifted to a more market-based regime for setting the yuan’s exchange rate. The move was accompanied with a small devaluation; the yuan now stands about 3 % lower against the dollar than it did at the beginning of last week. The minor drop in the exchange rate will have only a tiny impact on the price competitiveness of Chinese export industries, so market comments emphasizing the devaluation appear as overblown. Daily fluctuations in the exchange rate have since been minimal, but volatility is expected to increase. A more market-based formation of the yuan’s exchange rate is important in setting the stage for progress in economic reforms and increasing the flexibility of monetary policy.

Chinese exchange rate policy also has to deal with the acceleration in capital outflows seen in the first half of this year. According to media reports the PBoC has stabilised the yuan’s market rate to reduce pressures that might otherwise cause capital outflows to pick up. Officials have also given assurances that they will continue to support stock markets. Government intervention to stabilise stock markets is not a sustainable solution, if the aim really is to give markets more power in the economy.

While the risks associated with the opening of financial markets should not be understated, there are no clear signs that the real economy is in excessive trouble. Indeed, available information suggests growth has slowed more or less as expected. Related to exchange rate issues, the contraction in exports has been balanced by a contraction in imports, so China’s current account surplus continues to grow.

Yuan-dollar and yuan-euro exchange rates

Source: Reuters