BOFIT Weekly Review 33/2015

Chinese economic growth continues to slow

July figures released this week on foreign trade and trends in the domestic economy support the view that China’s economy continues to slow. Even so, China’s poor foreign trade performance was weaker than expected and worse than in June. Exports and imports were both down about 8 % y-o-y. The contraction in exports came as a surprise as June exports had returned to positive growth. The contraction in imports mainly reflected lower global commodity prices.

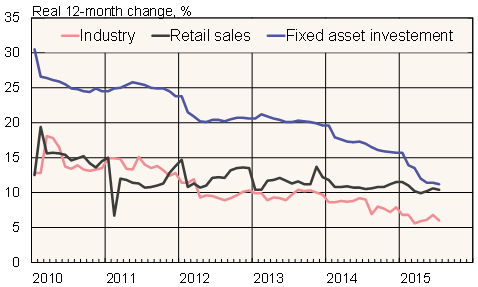

Industrial output, retail sales and fixed asset investment (FAI) in July grew slightly slower than in June. Industrial output in July was up 6 % y-o-y, down by nearly a percentage point from June. The various purchasing manager indices all foreshadowed a slowdown in industrial output. FAI was up 11 % y-o-y, the lowest growth seen in at least a decade. Retail sales increased in July about 10 %, and private consumption has increasingly become the driver supporting economic growth. Consumer price inflation accelerated slightly in July to 1.6 % y-o-y, while the fall in producer prices accelerated to 5.4 %.

Industrial output, retail sales and fixed investment, %

Source: Macrobond