BOFIT Weekly Review 33/2015

China devalues yuan and announces plans to increase role of markets in exchange-rate setting

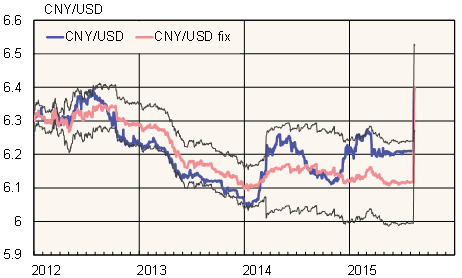

The People’s Bank of China announced Tuesday (Aug. 11) a lowering of the yuan daily reference rate by 1.9 %. The central bank fixes the reference rate for China’s forex markets every trading morning. Trading during the day can be conducted within a fluctuation band of ± 2 % of the fixing rate. The entire band was shifted on Tuesday. The spot market rate has undershot the daily fixing rate since late 2014.

More significantly perhaps, the PBoC said it would let the market, and specifically large designated market-maker banks, play a greater role in determining the reference rate. Many observers now expect that the yuan’s external value will experience wider swings as market conditions vary. The regime change is an important step in China’s efforts to liberalize its exchange rate practices ahead of the yuan’s possible incorporation into the IMF’s SDR basket currency. IMF experts recently recommended that China move to a floating exchange rate within 2–3 years, and the Fund has welcomed the central bank’s latest move.

The yuan enjoyed years of appreciation pressure from strong growth of China’s economy. The yuan last year was relatively stable vis-à-vis the US dollar, but gained roughly 20 % against the euro and about 18 % against the Japanese yen. In June, the yuan’s real effective (trade-weighted) exchange rate (REER) was up about 14 % y-o-y. In early summer IMF estimated that the yuan’s REER has risen so much that the yuan can no longer be considered undervalued. While the yuan’s daily swings seen this week were substantial from a Chinese perspective, the fundamental changes in the exchange rate regime are what matters.

Several observers note that the ostensible purpose of the latest devaluation was to help Chinese exporters, who saw the value of exports fall nearly 9 % y-o-y in July. On the other hand, the value of imports also contracted in the first half of the year, causing China’s current account surplus to soar. Moreover, Chinese officials must also consider the additional effects of yuan depreciation on capital outflows.

Yuan-dollar rate, daily fixing rate and fluctuation band

Source: Macrobond, BOFIT