BOFIT Weekly Review 33/2015

Russian imports suffer as economy falters

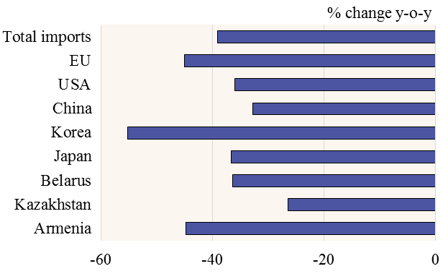

Preliminary Rosstat figures show the pace of contraction in Russian GDP reached 4.6 % y-o-y in the second quarter of this year. At the same time, the dollar value of Russia’s good imports declined 40 % y-o-y (24 % in euro terms). Preliminary figures from Russian customs also show the nosedive in imports became slightly worse in July. Highlighting the drop in investment, imports of machinery, equipment & transport vehicles were off by nearly 50 % y-o-y in 2Q15.

As trade sanctions imposed on Russia by the EU, US and other countries have been narrowly drawn, their direct impact on Russian imports has been rather mild. Russia’s counter-sanctions on food imports also concern only a small share of the country’s total goods imports. Imports from Russia’s trading partners have in fact contracted sharply across the board, not just with countries participating in sanctions.

In dollar terms, the value of Russian goods exports contracted 30 % y-o-y in 2Q15, due mainly to lower oil prices. Nevertheless, crude oil export volumes were still up 7 % y o-y and petroleum products 10 % (even if growth was lower than in the first quarter). Export volumes of certain metals and fertilisers were also up in the second quarter. The EU remains Russia’s largest export market, accounting for about half of all exports.

Russian goods exports in 1H15 contracted nearly 30 % y-o-y to just over $180 billion. Goods imports were worth just over $90 billion, down nearly 40 % from a year ago.

12-month change in Russian goods imports (January-June)

Source: Federal Customs Service of Russia