BOFIT Weekly Review 32/2015

Direct investment flows into and out of China continue to rise

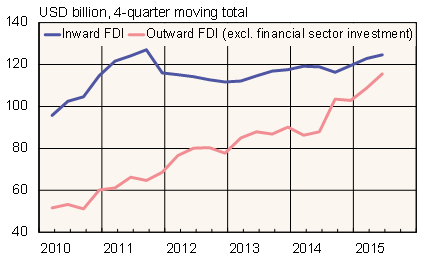

Foreign direct investment (FDI) into China in the second quarter amounted to $34 billion, an increase of 6 % from 2Q14. Outbound FDI from China (excluding the financial sector) was up 29 % y-o-y, reaching $30 billion in the second quarter of this year.

Growth in inbound FDI to China has accelerated this year. Of the major countries, the biggest sources of inbound FDI were Japan, the United States and Germany. However, a significant share of investment flows to China came via financial centres and tax havens, so their original home country cannot be discerned from official figures.

Chinese firms earlier had to get permission from officials before investing abroad. Since last autumn, they only have had to report their investments to officials. Moreover, Chinese officials this summer eased the rules on buying forex needed for foreign investments. Consequently, Chinese outbound FDI growth has continued to pick up the pace over the past year. Large investments in e.g. hotels in the US, as well as real estate and the energy sector in Europe, have attracted wide attention. FDI from Chinese firms only began to rise in recent years, so the overall stock of Chinese FDI abroad is still quite modest.

FDI flows into and out of China

Source: CEIC