BOFIT Weekly Review 32/2015

CBR lowers key rate again

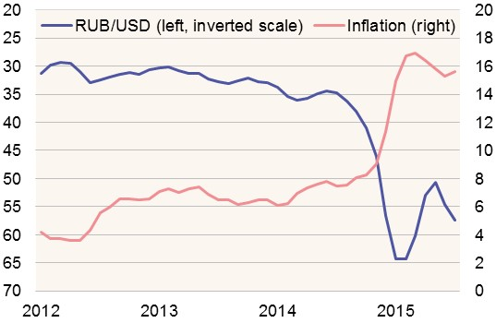

Effective Monday (Aug. 3), the key rate was lowered a half percentage point to 11 %. The Central Bank of Russia stated that the weak economy justified a further rate cut, although inflation risks have risen due to external factors. The ruble has lost considerable ground in recent weeks primarily pushed by the drop in oil prices.

The CBR has gradually lowered interest rates since February in response to the weakening economic development as money markets have been calming. The key rate now stands just a half percentage point above its level of last December, when the CBR was forced to raise rates quickly in an effort to stem the ruble’s slide and the resulting spike in inflationary pressure.

Consumer prices were up 15.6 % y-o-y in July. Inflation accelerated a bit from June to July, mainly on hikes in regulated prices that were larger than last year. The on-year rise in food prices slowed slightly in July, but was still 18.6 %.

Ruble-dollar rate and 12-month consumer price inflation (%)

Sources: Rosstat, Reuters