BOFIT Weekly Review 31/2015

Increase in domestic indebtedness in China continues to outpace economic growth

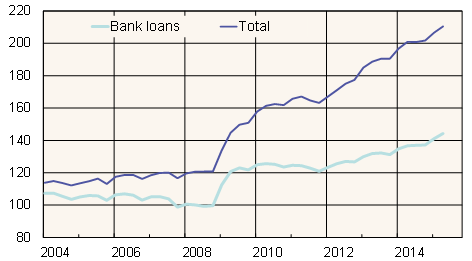

Total social financing, the broader definition of the credit stock used by the People’s Bank of China, was up 12 % y-o-y in 2Q15, while nominal GDP growth was 7.1 %. Even so, growth of the credit stock slowed from a year earlier, when it ran at nearly 17 %.

April-June figures also indicate the structure of China’s credit stock is changing. On-year growth in the stock of bank loans remained at around 13 %, while growth of other financing formats was up just 11 %. Lending outside the formal banking sector has slowed significantly. Notably, growth in loans from trust firms fell below 2 % y-o-y.

Funds raised through share emissions are also included under the total social financing concept. The rise in share prices and new IPOs on China’s stock exchanges helped fuel growth in the category in the first half. Assets raised through share emissions, however, represent just 5 % of the increase in China’s total credit stock in 1H15.

Credit stock to GDP, percentage of GDP

Sources: Macrobond, BOFIT