BOFIT Weekly Review 31/2015

Views of Russian authorities differ slightly on outlooks for the economy’s recovery; oil prices and the ruble slide

Several official authorities in Russia last spring proclaimed the worst of Russia’s economic contraction was over. Yet, prime minister Dmitri Medvedev last week stated that the Russian economy may return to growth only late this year or early next year. Economy minister Alexei Ulyukayev, on the other hand, repeated his ministry’s earlier assessment that the economy was still on course to enter recovery in the third quarter of this year. The ministry now sees inflation moderating a bit faster than in its late spring forecast. This improves their outlook for real household incomes and private consumption.

Alexei Kudrin, who served as finance minister from 2000 to 2011, expects the economic contraction to continue in the fourth quarter of this year, even if more slowly than until then, and growth to return in the first half of 2016. Kudrin noted that the drop in economic output accelerated in the second quarter of this year, adding that fixed capital investment continued to fall much.

Observers note that expectations of recovery have moderated as more recent figures on the deepening of the economic contraction have emerged. The economy ministry estimates GDP in the second quarter was 4.4 % lower than a year earlier, even if seasonally adjusted GDP only contracted slightly in June.

The oil price has also declined, after recovering from the plunge of the second half of 2014 to around $65 a barrel in early May. The latest slide sharpened at the end of June. This week the Urals price dipped below $55/bbl.

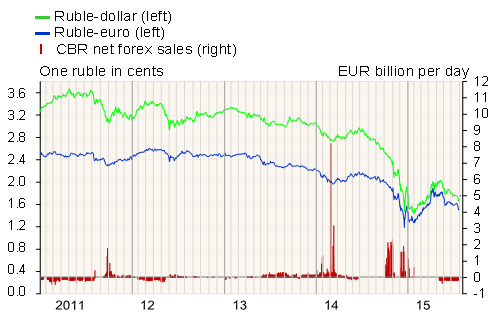

The drop in oil prices and financial uncertainty in China especially since mid-June have eroded exchange rates in other emerging economies as well as the ruble’s exchange rate which this week was down about 15 % from end-May against both the euro and the dollar.

On Tuesday (July 28), the CBR, citing increased market volatility, suspended its daily forex buying on Russia’s forex market. The CBR in mid-May initiated the buying policy in order to gradually rebuild the country’s foreign currency reserves. From the standpoint of the ruble’s exchange rate, the currency buying, usually $200 million a day, has had no decisive impact.

Ruble exchange rates and CBR forex sales on Russian market

Source: Central Bank of Russia