BOFIT Weekly Review 30/2015

China’s housing market shows signs of recovery

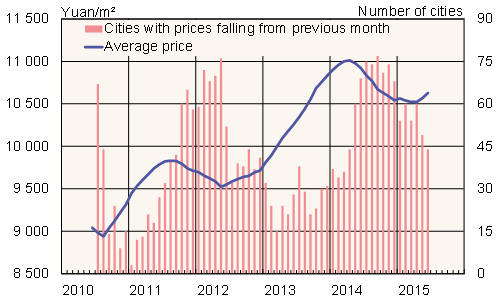

SouFun, a private real-estate information tracking service, reports average apartment prices showed a slight uptick overall in the second quarter. Apartment prices were still down 3 % y-o-y in June, however, and 3.5 % below their peak in April 2014. Two other major private real-estate tracking firms also detected a rise in average apartment prices in June.

SouFun noted price declines from the previous month in 44 of the 99 cities tracked, compared to last autumn when prices were down in three-fourths of the cities tracked. China Real Estate Information Corporation reports prices rose in about half of the 288 cities it monitors. China’s National Bureau of Statistics also noted in its housing price survey of 70 cities that prices for new apartments were up in 27 cities in June (compared to 20 in May). Notably, rises were seen in the major metropolises such as Beijing, Shanghai and Guangzhou (each up 2 % in May), as well as Shenzhen (up 7 %). Still, prices continued to fall in almost half of the cities tracked by the NBS. Prices fell in smaller cities that, in particular, are suffering from an oversupply of apartments.

Officials last autumn sought to support the housing market by easing rules on purchasing of a second apartment. The PBoC has lowered its key rates this spring and summer, as well as reserve requirement ratios for banks. Certain local governments have also purchased unsold apartments and resold them to low-income households at discounted prices.

Growing uncertainty on stock markets could increase demand for the perceived relative safety of real estate investment. Indeed, a China Household Finance Survey conducted at the end of last month suggests households may be increasingly pulling out of the stock market and investing instead in an apartment.

Average housing prices and number of surveyed cities (99 city sample) where housing prices fell from previous month

Sources: SouFun, Macrobond