BOFIT Weekly Review 29/2015

Russia’s current account surplus persists, outbound capital flow diminishes

Preliminary balance-of-payments figures show that Russia’s current account surplus amounted to nearly $20 billion in the second quarter of this year. Over the past four quarters, the surplus corresponded to about 4 % of GDP.

In the second quarter, the value of goods and services exports shrank nearly 30 % y-o-y in dollar terms, while imports were down 40 % in dollar terms (20 % in euros). Foreign trade also contracted nearly as much in the first half as a whole. For the January-June period, the value of exports was $210 billion and the value of imports $140 billion.

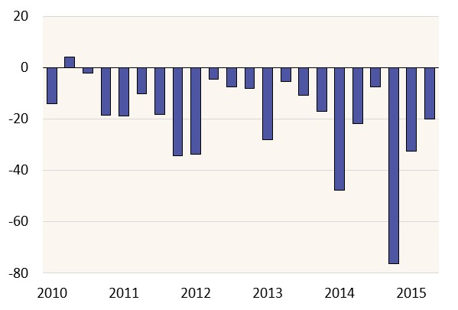

Capital outflows from Russia continued in the second quarter, but were slower than earlier. The private sector’s net capital outflows amounted to about $20 billion.

Banks continued to pay down their foreign debt faster than they acquired new foreign debt, but not quite as fast as in the first months of 2015. Moreover, banks invested more of their assets abroad than they repatriated.

In contrast, the foreign debt held by other firms increased in the second quarter for the first time in nearly a year. Most of the new debt is from direct investors. Non-banks, however, still invested more abroad than repatriated their assets.

Quarterly net capital flow of Russia’s private sector (USD billion)

Source: Central Bank of Russia