BOFIT Weekly Review 25/2015

CBR governor Nabiullina discusses outlook for Russia’s foreign currency reserves

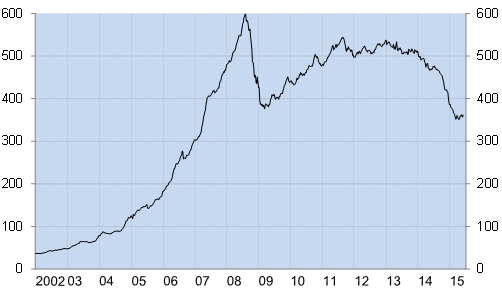

At a banking conference in St. Petersburg at the start of this month, CBR head Elvira Nabiullina noted that Russia’s current level of foreign currency reserves (about $360 billion) is quite adequate by international standards. For example, the reserves are large enough to cover nearly eleven months’ worth of imports. However, given the special features of the Russian economy and current market conditions, Nabiullina said she considered optimal that currency reserves would cover 2 3 years of substantial capital outflows. The CBR estimates this would require currency reserves of about $500 billion. Russia’s currency reserves shrank last year by about $125 billion, largely on capital outflows.

Nabiullina said increasing the currency reserves to $500 billion would be accomplished through gradual currency purchases spread out over several years. The central bank began currency buying in mid-May and has been spending on average about $200 million a day. As of mid-June, currency purchases totalled about $3.8 billion.

The CBR has emphasised that gradual increasing of the currency reserves is not conflicting with the current policy of inflation targeting and that it is not meant to maintain the ruble at a specific exchange rate. The ruble began to lose ground against the euro and the dollar at the end of May after nearly four months of appreciation. In recent days, the ruble’s exchange rate has stabilised. Many market participant comments on the CBR’s currency buying have reflected surprise over the policy direction. Last November the CBR said it would let the ruble float.

Russia’s currency reserves 4.1.2002−5.6.2015, USD billion

Source: CBR