BOFIT Weekly Review 23/2015

Chinese share prices ride the rollercoaster

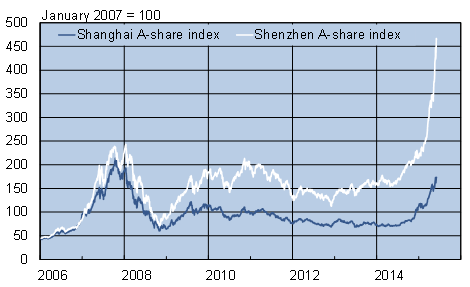

At the end of last week, Chinese share prices plunged dramatically, leading many to believe a major correction was under way. Share prices fell 6 % in one day on the Shanghai stock exchange. On the Shenzhen exchange, prices were down 5.5 % and in Hong Kong 2.2 %. Trading in a specific share on the Shanghai exchange is halted if its intraday price falls or rises 10 %. Last Thursday, about a quarter of traded shares hit their bottom limits.

At the start of this week, share prices rebounded, returning to the same level as before last week’s panic. A variety of explanations have been offered as to the cause of recent spikes and falls in share prices, but shifting market sentiment is likely an underlying factor. The continuing rapid rise in the number of small investors entering the market and increased trading on margin have contributed to higher volatility. Chinese stock market trends have become increasingly speculator-driven, and, in the view of many, decoupled from trends in the real economy.

Stock market trends in mainland China

Source: Bloomberg

Share prices have skyrocketed over past five months. In mainland China, where most trades involve small investors, share prices have risen considerably faster than share prices elsewhere in the world. On the Shanghai exchange, share prices are up nearly 50 % since the start of the year, while Shenzhen share prices have doubled. In Hong Kong, too, share prices are up about 20 % since the beginning of the year. Price-to-earnings (P/E) ratios, a rough measure of share value relative to company performance, are now seen as unrealistic.

A major correction in share prices would create a new set of problems, particularly for investors who have bought shares with borrowed money. Thanks to trading rules, share prices in mainland China by definition cannot collapse overnight. Over the long run, however, the collapse of a share bubble is likely to depress stock market activity for years as it did after the collapse of the 2007 share bubble. This would increase China’s debt problems by making companies more dependent on debt financing. An even more serious problem from a market collapse would perhaps be to impede progress in much-needed financial market reforms for stock market development.