BOFIT Weekly Review 20/2015

PBoC cuts interest rates and continues deregulation of deposit interest rates

On Monday (May 11), the People’s Bank of China lowered its reference credit rates by 25 basis points. The one-year credit reference rate for banks now stands at 5.1 % and the deposit reference rate at 2.25 %. The rate cuts reflect the weak growth outlook and low inflation environment. Consumer price inflation accelerated only marginally to 1.5 % in April, while producer prices were down 4.6 % y-o-y, the same as in March.

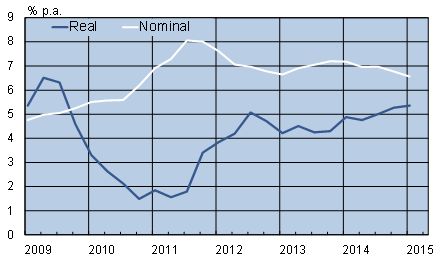

The rate cut has only minor effect on the real economy as credit rates were deregulated in summer 2013. Interbank rates have gone down sharply over March–May, but this has yet to be reflected in general interest rates (see chart).

The deregulation of deposit rates is actually more important than the reduction of reference rates. Banks are now permitted to pay deposit rates 50 % above the reference rate (earlier 30 % above the reference rate). As a result, the ceiling on deposit interest rates is now 3.38 %. The formal deregulation of deposit rates is no longer a big step, although even after that China’s banking system and monetary policy will not automatically function on a market-driven basis due to the central role of the state banks.

Average bank lending rates, %

Sources: Macrobond, BOFIT