BOFIT Weekly Review 15/2015

Chinese stock markets heat up

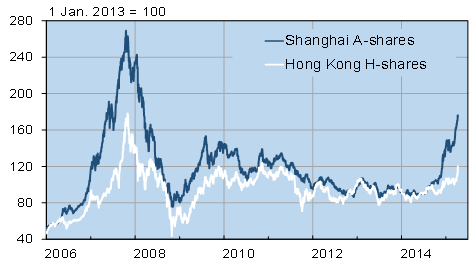

The main driver of the recent rise in Chinese share prices has been increased interest among small investors in owning stocks. Private investors account for about 80 % of trading on mainland China stock exchanges. The poor returns from alternative investments have further fed the frenzy to own shares. Share prices on both the Shanghai and Shenzhen stock exchanges are up nearly 90 % from a year ago, and there has been a manifold increase in the volume of trade.

The heightened interest of private investors can be seen by the fact that investors opened over 200,000 new brokerage accounts a day in March, up from an average of 30,000 accounts a day in March 2014. The practice of margin trading (i.e. purchase of shares on credit) has also exploded. As of end-March, the stock of margin-bought shares in mainland China exchanges totalled 1.5 trillion yuan (€225 billion), up from 400 billion yuan in March 2014.

Even ordinary people have taken interest in shares. Bloomberg reported that, based on data from the China Household Finance Survey from the end of last year, over 30 % of novice investors in stocks had only finished elementary school, up from 8 % earlier. Small investors prefer to buy shares with a low unit price; such shares have seen much greater appreciation than more valuable shares.

Observers worry that the private investor stampede into shares may increase price volatility. Share price performance defies the current outlook for the slowing real economy. Moreover, share prices have risen on investor expectations of looser policy. Recent monetary easing has further fuelled the rise and thus the impacts of the easing on the real economy have remained relatively small.

Share prices on Shanghai and Hong Kong exchanges

Source: Macrobond

Foreign investors in Hong Kong have stepped selling shares bought on the Shanghai exchange via the “Stock Connect” arrangement. The value of trades conducted under the arrangement amounted to 1.2 % of the turnover on the Shanghai exchange in March. Short selling of shares under limited conditions via the cross-border link was introduced in the Shanghai exchange in March. The short-selling possibility has yet to attract the interest of foreign investors.

The interest of Chinese investors in relatively cheaper Hong Kong shares has continued to climb in recent days and the share prices in Hong Kong have also risen sharply. Investing in Hong Kong via Stock Connect was recently allowed for mainland Chinese mutual funds, which has fuelled the increase in trade volumes. Mutual funds’ investment in foreign shares was earlier allowed only under the qualified domestic institutional investor (QDII) programme. The overall trading share of mainland Chinese on the Hong Kong exchange has still remained modest.