BOFIT Weekly Review 15/2015

Ruble appreciation enters third month

The ruble’s recent recovery reflects stabilisation of global oil prices and reduced foreign currency demand in Russia. Demand for foreign currency is no longer as acute as at the start of the year when Russian firms and banks paid significant foreign loan instalments falling due. The collapse in import demand and the introduction of the Central Bank of Russia’s new forex repo credit arrangement have further dampened currency demand.

Observers note that the ruble’s severe decline in December and January overshot the mark, setting the stage for the current correction. Some now argue that the rebound has largely run its course and that the ruble’s exchange rate should soon stabilise.

Nevertheless, the ruble remains sensitive to international political events that could again lead to wide swings in the ruble’s exchange rate.

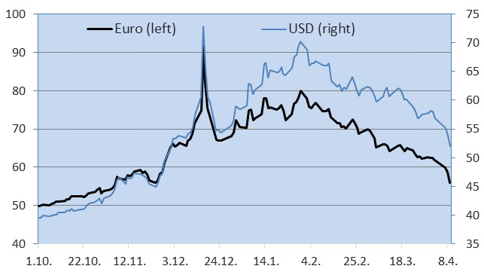

Euro-ruble, dollar-ruble rates, 1 Oct. 2014–9 Apr. 2015

(falling trend indicates ruble appreciation)

Source: Thomson Reuters