BOFIT Weekly Review 13/2015

BOFIT 2015–2017 forecast sees further slowdown in China’s growth without certainty of a soft landing

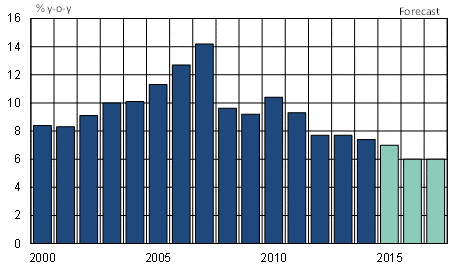

The latest BOFIT Forecast for China came out this week. We expect Chinese economic growth this year to come in at around 7 % and then slow to around 6 % in 2016. The new forecast largely matches our forecast of September 2014. Our forecast is based on the assumption that China continues to move ahead with bold reform policies and avoids large economic shocks. In this case China could also achieve GDP growth of around 6 % in 2017. A controlled “soft landing” of the economy is by no means set in stone, however, as risks to the economy have continued to grow.

Realised GDP growth and BOFIT forecast for 2015–2017

Sources: NBSC and BOFIT

Lower growth is by and large a good thing for China as it allows structural changes in the economy to continue, and increases the roles of private consumption and services in the economy. Excessive investment resulting from e.g. broad stimulus measures has exacerbated environmental harms, fuelled indebtedness, allowed assets to be squandered on unprofitable ventures and created excess supply in many branches. China’s high-growth paradigm emphasising massive investment has reached the end of the road.

The slowdown in growth also highlights the importance of achieving deliberate progress in economic reforms. With the employment situation relatively strong and inflation running at modest levels, it seems an auspicious moment to move ahead with reforms. Indeed, reforms should be expanded to take on the thorniest issues such as reform of state-owned enterprises. Reforms of financial markets are at the moment proceeding for the most part as planned.

Risks to the economy have increased since our last forecast. The biggest risks are growing debt problems and increased challenges in the real estate sector. Dealing with the growing debt problems will be harder midst the lower economic growth. China’s domestic credit stock now exceeds 200 % of GDP. The growth of credit has been especially high in the shadow banking sector, which is much less regulated and supervised than the regular banking sector. Low inflation has also driven up real interest costs. The debt problem limits monetary policy, and the central bank must carefully consider whether and how much monetary easing is appropriate, especially if labour conditions remain stable.