BOFIT Weekly Review 13/2015

Latest BOFIT forecast sees further contraction of Russian GDP and imports this year, with slow recovery thereafter

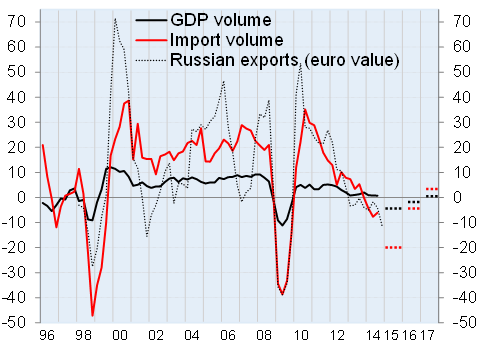

The Russian economy slowed for the third consecutive year with growth coming nearly to a standstill in 2014. With the price of oil down by nearly half (from last year’s average price), the economy has entered a contractionary phase.

In our latest Forecast for Russia, we see Russian GDP contracting this year by over 4 % as long as the oil price does not rise much above $55 a barrel. Further, the Ukraine situation, financial and trade sanctions from the West, along with counter-sanctions from Russia and the slide in the oil price, have increased uncertainty surrounding the Russian economy. Sanctions are expected to remain in place for a considerable while and access to foreign financing will remain challenging. Government spending is expected to contract in real terms.

The volume of imports fell 7 % last year. We estimate that weak domestic demand, the frail ruble and Russia’s reduced export earnings will cause imports to contract this year by approximately 20 %.

For 2016 and 2017, the average oil price will rise to around $65 a barrel. Russian export earnings will recover. The economic contraction and drop in imports shall gradually end and then begin slow recoveries in 2017. The real exchange rate of the ruble should also appreciate as inflation in Russia is significantly higher than in its main trading partners (the gap has widened to over 10 %).

High inflation will cause private consumption this year to decline significantly. The outlook for wage increases is slim and recovery in consumption will take time. Investment is expected to contract substantially this year and also next. Private investment, in particular, has been stifled by uncertainty arising from the continuous tensions in eastern Ukraine, the unclear sanctions outlook and the possibility of more sanctions. The picture is further clouded by the unpredictability of Russia’s economic and trade responses in a looming recession. Volumes of exports will increase quite slowly, due in part to hardly any growth in energy exports.

Russia’s leadership has responded actively to the onset of recession. However, even if government spending cuts have now become policy, the 2015 federal budget deficit will amount to around 3.5 % of GDP (at an assumed oil price of slightly over $55) and may force the government to use about half of the Reserve Fund. Russia’s reliance on the Central Bank of Russia to cover (via banks) the budget deficit and provide financing to firms for paying off foreign debt has for its part increased the CBR’s receivables from banks to unprecedented levels. Besides providing state financing, the leadership has increased “manual steering” of parts of imports and exports of capital as the country has come to the brink of recession.

Our forecast sees large risks associated especially with fixed capital investment and imports. Various uncertainty factors could further erode the motivation of private firms in the real economy to invest, while increasing outflows of private capital from Russia. Changes in capital outflows and the oil price are rapidly reflected in the ruble’s exchange rate, Russia’s export earnings and imports.

Conditions that would foster economic growth and development continue to degrade as private investment declines and government spending focuses increasingly on defence and pensions. Subsidies and restrictive measures to stave off a recession are likely to reduce competition and choke off what little incentive remained for reforms.

Russian GDP, imports and earnings from exports of goods and services, % change y-o-y

Sources: Rosstat, CBR, BOFIT