BOFIT Weekly Review 11/2015

Domestic demand shows signs of weakening in China

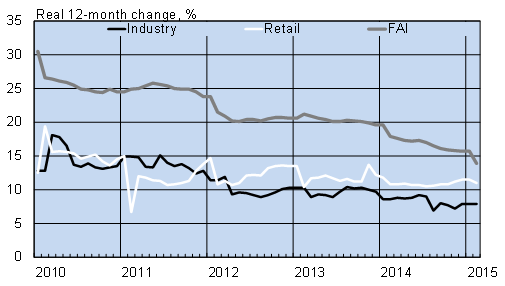

Several key economic indicators came in below market expectations for the first two months of this year. Among other things, the figures suggest a softening in domestic demand. January-February industrial output was up 7 % y-o-y, a percentage point less than in December 2014, while the markets expected 8 % growth. Weak domestic demand has been a large driver of slowing growth, while export growth continues to thrive. Although consumer demand is still robust, retail sales growth has also slowed by a percentage point from December. On-year growth in retail sales was 11 % in the first two months of this year.

The 12-month rise in consumer prices accelerated from 0.8 % in January to 1.4 % in February. While food prices largely explain the acceleration, prices in several other goods categories also increased. Producer prices are declining for the third year due to falling prices for energy and raw material inputs as well as industrial overcapacity. The slide in producer prices accelerated in February to 4.8 %.

Even with the slight pickup in inflation, real interest rates are still high, which for its part has slowed growth in fixed asset investment (FAI). FAI increased by 14 % y-o-y in the first two months of this year, down from 16 % in 2014. Growth in industrial investment slowed by 3 percentage points in January-February to 11 % y-o-y. In contrast, growth in real estate investment remained nearly unchanged at 10 %. Investment in infrastructure continued to grow at a 21 % y-o-y pace.

Industrial output, retail sales and fixed asset investment, %

Source: Macrobond