BOFIT Weekly Review 09/2015

Financial markets enter the Year of the Goat calmly

There were few surprises when the financial markets reopened on Wednesday (Feb. 25) after the week-long Lunar New Year holiday. Key money market rates and share prices were barely changed from the start of the New Year’s holiday.

Since the beginning of November, the yuan has lost value against the US dollar on the forex markets. This week the yuan-dollar exchange rate hovered around 6.26 to 6.27. As the People’s Bank of China’s yuan-dollar daily fixing rate has been about 6.14, the yuan’s exchange rate was effectively hitting the ceiling of its widened 2 % trading band. So, further weakening against the dollar will require a resetting of the fixing rate or a wider trading band. Measured according to trade-weighted nominal and real exchange rates, the yuan has continued to appreciate.

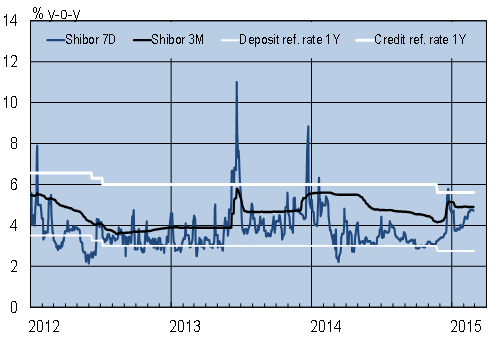

The outlooks for economic and monetary policy have not substantively changed over the past couple of months. Monetary policy seeks to balance lower economic growth, low inflation and rising indebtedness. At the beginning of February the PBoC cut the reserve requirements of commercial banks by half a percentage point, but this has not yet broken the increasing trend of short-term rates on the money markets. Slowing inflation and falling producer prices have increased pressure on real interest rates to rise further. The PBoC’s ability to use monetary policy to support economic growth is limited, but on the reform policy side there is plenty of untapped potential to secure healthy growth over the longer term.

Chinese interest rates (policy and market rates), %

Source: Macrobond