BOFIT Weekly Review 08/2015

Prices for shares listed in Shanghai higher than in Hong Kong

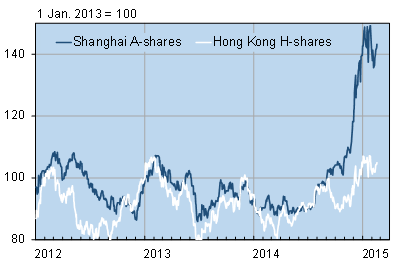

The sharp rise in prices on the Shanghai stock exchange at the end of last year has moderated. At the close on Tuesday (Feb. 17), the Shanghai Composite Index stood at the same level as on December 31. On Wednesday, Chinese exchanges began the week-long Lunar New Year hiatus.

Shares listed on the Shanghai exchange have risen rapidly, creating a situation whereby the same share in Shanghai is more expensive than in Hong Kong. The value of A-shares of Chinese firms listed in Shanghai has risen over 40 % since last September, while the rise in H-shares of Hong Kong’s China Enterprise Index are up less than 10 %. The price-to-earning ratio (P/E), an indicator of share priciness, is now about 16 for Shanghai A-shares, but below 9 for Chinese companies listed on the Hong Kong exchange. In January, the shares of the same big firms listed on both the Shanghai and Hong Kong exchanges were on average 26 % pricier in Shanghai. Up to last autumn, Hong Kong-listed shares tended to carry a premium.

Shanghai A-share and Hong Kong H-share indexes

Source: Macrobond

The stock connect experiment launched last November on the Shanghai and Hong Kong stock exchanges offers investors (in theory, at least) equal access to both markets, so one would expect diminished price differences and fewer arbitrage opportunities. Trading in Shanghai-listed shares via the Hong Kong exchange has not been entirely seamless, however, and Chinese firms are still relatively unknown to foreign investors. Only 35 % of the 300-billion-yuan (USD 50 bln.) quota for foreign investors on the Shanghai exchange has been used, and foreign investors have on average accounted for less than 2 % of the Shanghai exchange’s daily trading volume. The rapid rise in Shanghai share prices has largely been driven by the increased interest in share trading of private Chinese individuals. Only Chinese investors with large investment funds are permitted to invest in Chinese shares via the Hong Kong exchange, and just 10 % of the 250 billion yuan quota has been used.

Prices on mainland China’s number-two exchange, the Shenzhen stock exchange, continued to rise in the first weeks of this year, and now are up about 15 % from the end of last year. There are also plans for a partial opening of the Shenzhen stock exchange to foreign investors via the Hong Kong exchange. Shenzhen has listed numerous growth firms, while large state-owned enterprises dominate the Shanghai exchange. This is also apparent in share pricing: the average P/E ratio of Shenzhen A-shares is 37.