BOFIT Weekly Review 07/2015

Yuan appreciates in both real and nominal terms

Discussions on trends in the Chinese currency typically focus on the exchange rate between the yuan and the US dollar due to the dominance of the dollar in international payments and its use as the reference currency for Chinese foreign exchange policy. However, just tracking one currency pair gives a limited picture of what is actually happening in the forex world and more generally in trends in China and the global economy. For example, since the start of the year the yuan’s exchange rate relative to the US dollar has weakened nearly 1 %, but appreciated 7 % against the euro.

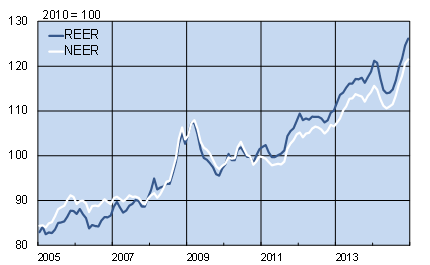

The trade-weighted “nominal effective exchange rate” (NEER) provides a broader overview of exchange rate trends. In 2014, the yuan’s NEER rose about 6 % relative to the currencies of China’s main trading partners. The “real effective exchange rate” (REER), in contrast, also takes into account differences in China’s inflation rate relative to those of its main trading partners. Thus, the REER provides a clearer assessment of shifts in price competitiveness. The yuan’s REER appreciated also about 6 % last year.

Over the past ten years, the yuan’s NEER and REER have appreciated about 50 % due to China’s robust economic growth and increased international use of the yuan.

With gradual liberalisation of exchange rate policy in recent years, the yuan has seen wider swings in its external value, as last spring’s weakening episode demonstrated. Pressures driving yuan appreciation such as significantly higher growth of the Chinese economy relative to other large economies and a booming goods trade surplus have lately been moderated by the services trade deficit, rising capital exports and increased risk in China’s financial markets.

Real and nominal effective exchange rates of the yuan

Source: BIS