BOFIT Weekly Review 05/2015

Growth of lending of China’s shadow-banking sector still outpaces lending growth of formal banking sector

The broad-stroke Chinese notion of lending, “social financing,” covers formal bank lending as well as a variety of instruments used in the shadow banking sector, which has seen its role increasing in China’s bank-centred credit system. Growth in the volume of formal bank lending last year slowed to below 13 % y-o-y, while the stock of informal financing instruments was up 18 % y-o-y at the end of 2014.

Nevertheless, growth in lending in the shadow-banking sector has actually slowed. Officials have managed to make headway in cracking down on growth of the most problematic shadow banking instruments, trust loans, through increased supervision. On-year growth in trust loans remained at 11 % in 4Q2014. However, while growth in the stock of entrusted loans has also declined, an inter-company loan in which banks act as intermediaries for a fee, the loan stock anyhow increased 30 % from December 2013.

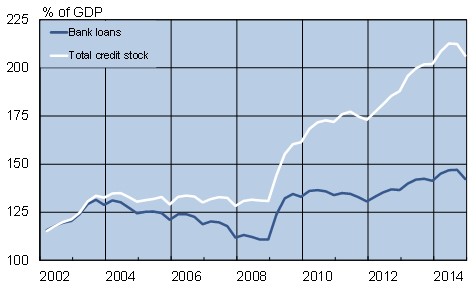

Given the slowdown in bank lending growth, China’s ratio of domestic debt to GDP began to fall towards the end of the year. The ratio of total credit (including non-government and non-financial debt) to GDP, however, still exceeds 200 %, which is remarkable for a lower middle-income country like China.

Ratios of bank loans and credit to GDP for China, %

Sources: Macrobond, BOFIT